The Federation of Small Businesses has called on Ofgem to address the escalating standing charges faced by small firms, highlighting the potential financial strain on many.

The Federation of Small Businesses (FSB) has increased pressure on Ofgem, calling for prompt action to tackle rising standing charges affecting small firms nationwide.

The FSB’s concern stems from the financial strain on small businesses, worsened by substantial increases in fixed charges, regardless of energy usage.

In a letter to Ofgem Chief Executive Officer Jonathan Brearley, the FSB outlined the negative impact of rising standing charges on small businesses.

This plea follows earlier correspondence from Energy Secretary Claire Coutinho and Minister for Affordability and Skills Amanda Solloway, highlighting the government’s commitment to fair energy bills for all consumers.

According to the FSB, small businesses, particularly those in rural areas, are hardest hit by these rising charges, exacerbating urban-rural disparities and hampering efforts to level up remote regions.

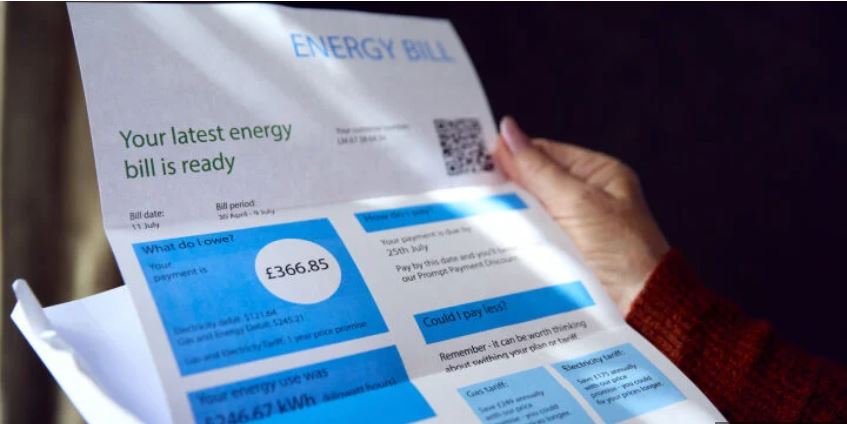

Standing charges, covering network infrastructure and operational costs, pose challenges for small businesses trying to understand utility bills.

Unlike household consumers, small firms lack protection from energy price caps, leading to suspicions of unjustified cost increases by energy suppliers.

FSB’s Policy Chair, Tina McKenzie, commented: “We want Ofgem to do a thorough review of standing charges for businesses as well as consumers, for better transparency and to discern whether energy companies are behaving fairly towards their small firm clients.

“Small business energy customers behave in a way more akin to consumers than big businesses, lacking the resources, the expertise and the buying power necessary to get the best possible deal out of their energy suppliers.

“However, they do not benefit from anything like the same level of protection as that rightly available to households, leaving them caught between two stools.

“Many small businesses could be forgiven for suspecting that they have been seen as something of a soft target for price hikes in their standing charges, and they do not have a full picture of where the money they pay on a daily basis is going – something that needs to change.

“Small firms were put through the wringer by the energy price crisis, which sadly spelled the end for many otherwise viable businesses who saw their utility bills become completely unmanageable.”

An Ofgem spokesperson: “We are assessing the standing charge system overall including tackling issues faced by non-domestic consumers. We are grateful for FSB for responding to our consultation and we are looking at its ideas.

“We agree too many businesses get unexplained price hikes from suppliers or are ripped off by brokers – that’s why we’re putting tough new rules in place from July to resolve disputes and get greater clarity on fees.

“We published a detailed non-domestic market review last year – and are working with ministers, industry and businesses on the additional price protection and bill transparency they’re calling for.”

Simon Askew, Managing Director at Business Energy Direct, said: “Further to the recent article regarding the soaring cost of standing charges, which has been published by multiple mainstream media outlets, Business Energy Direct is disappointed with the comments, from Ofgem which are damaging to reputable brokers and third-party intermediaries.

“Ofgem’s poorly considered comments come off the back of the FSB highlighting concerns regarding excessive increased costs on behalf of their members and small businesses, concerns that Business Energy Direct share, having repeatedly contacted Ofgem regarding the impact of P272, P432, Market wide Half Hourly Settlement (MHHS) and Targeted Charging Review (TCR).

“All of these poorly considered industry changes were approved by Ofgem, despite opposition from the supply industry and other stakeholders, with TCR being the most recent of the changes to be implemented, and the noticeable increases can be directly attributed to it.

“When announcing the decision to approve TCR, Ofgem stated “We have decided to make changes to the way in which some of the costs of the electricity networks are recovered, so that the ‘residual charges’ are recovered more fairly now and, in the future”.

“Following the request for comments to the recent article, Ofgem had the opportunity to educate the public about the industry changes that they approved, in particular TCR, but instead they decided to make defamatory comments against a sector of industry that doesn’t make policy decisions, one which had nothing to do with the issues the FSB highlighted.

“Despite evidence of poor supplier practices, which on occasion have been identified as introduced deliberately for the benefit of the supplier, and the circa £500 million fines issued to suppliers following enforcement action, Ofgem has refrained from using derogatory and inflammatory language when providing comments to the media in the past.

“The majority of brokers and TPIs work incredibly hard to protect the interests of the millions of business customers that they work with, despite the poor performance of our industry regulator, and we believe that Ofgem should retract or amend their comments accordingly.”

Copyright © 2024 Energy Live News Ltd