UK businesses seek government support for net zero

Nearly 96% of businesses are calling on the next government to prioritise providing increased government support, which includes financial incentives, a according to a new survey. A recent study conducted by BSI suggests that the majority of UK businesses are advocating for greater governmental assistance to achieve net zero emissions by 2050. The research, based on a survey of over 1,000 […]

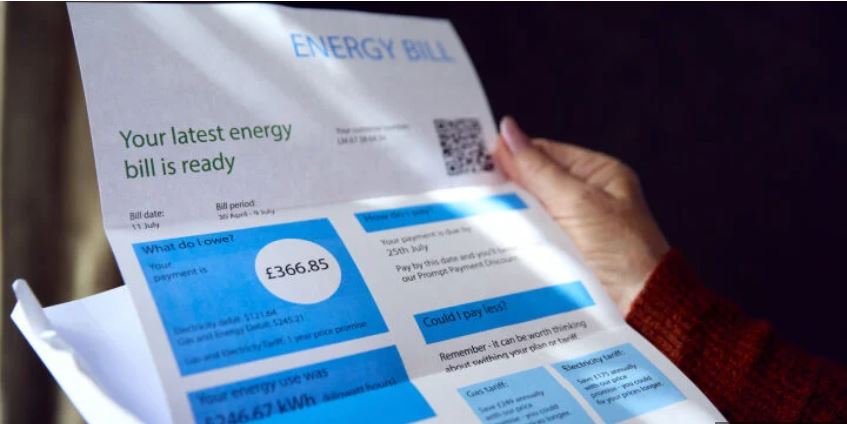

Ofgem wraps up consultation on energy price cap

Energy regulator Ofgem has closed its consultation on the energy price cap, which was initially introduced in 2019 to safeguard consumers on variable tariffs. Britain‘s energy regulator, Ofgem, has completed its consultation on the energy price cap, initially introduced in January 2019 to protect consumers on variable tariffs. Since 2022, the cap has undergone quarterly revisions, prompting Ofgem to assess […]

Ofgem consults on ending ban on acquisition-only tariffs

Ofgem is consulting on ending the ban on acquisition-only tariffs, with a proposed removal date of 1st October. Ofgem has launched a statutory consultation to explore the removal of the ban on acquisition-only tariffs, which restricts energy suppliers from offering tariffs exclusively to new customers. The consultation considers two potential timelines for the removal: after six months, starting […]

Energy networks: Strategic innovation crucial for UK decarbonisation

Energy network operators have emphasised the crucial role of strategic innovation in achieving the UK’s 2050 decarbonisation targets, outlining 24 key milestones including technology development, data sharing and infrastructure adaptation. Energy network operators have emphasised the crucial role of strategic innovation in guiding the UK towards its 2050 decarbonisation objectives. They have unveiled 24 significant “way points” […]

UK businesses struggle with soaring energy costs

Over a third of UK businesses report that unpredictable energy costs have hindered growth in the past year, according to a survey A recent report from Centrica Business Solutions reveals that more than half (56%) of UK businesses plan to increase their onsite energy generation capacity within the next two years. The report, titled “How data, onsite […]